Published

Reading time: 3min – video: 2min

2 minutes

A new method of calculating property tax, based on comfort and surface area of housing, is causing political outcry. More than 7 million homeowners could see their taxes rise, while the government considers a possible step back in the face of criticism.

This text corresponds to part of the transcription of the report above. Click on the video to watch it in full.

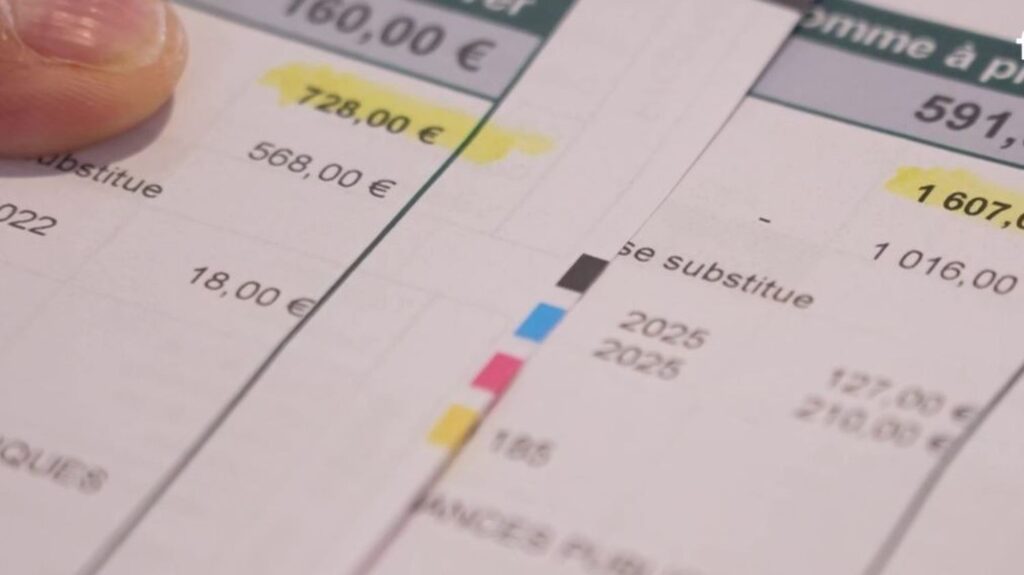

An extra room for Philippe Chantier, who extended his house two years ago. All the comforts on the ground floor for his old age, a total of 25 additional square meters that he had to declare for taxes. “We ask you for the comfort of home. If you have running water, gas, electricity, the number of toilets, the number of bathtubs, if you have a shower tray, the number of sinks…” details the owner. It is partly on the basis of these new elements that its property tax was recalculated upwards.

But not all owners made this spontaneous declaration. More than 7 million homes would be affected in 2026. Taxes consider that they are all equipped with modern comfort: running water, electricity or bathroom. This equipment increases the theoretical surface area of the property and therefore the property tax according to a precise scale: allow 2 square meters more per heated room, 5 square meters for a bathtub.

A measure which provokes a general political outcry, from the National Rally to the socialist parties. Jordan Bardella, president of the National Rally, declared during a microphone: “This is a blow in the back to French owners. We are resolutely opposed to it and I solemnly ask the Prime Minister to renounce this measure in a context, once again, extremely tense, which we are experiencing in the real estate market, but especially in the ends of the month of our compatriots”.

For Philippe Brun, PS deputy for Eure: “Property taxes have already increased significantly in recent years. It’s time for it to stop now.” Strong criticism also appears within the government camp. Prisca Thevenot, LREM MP for Hauts-de-Seine, declares: “Whether it’s automatic or a catch-up update, it doesn’t matter, we are opposed to it.”

Faced with the outcry, the government opened the door on November 19 to a possible abandonment of the measure. “We reserve the right to question the relevance of this measure in a few months during a progress update”, explains Maud Brégeon, government spokesperson during a press briefing.

All owners affected by this update will be notified by the tax service.

/2025/11/19/fbfdbfdb-691e1b4e277b1848036244.jpg)