Published

Reading time: 1min – video: 2min

2 minutes

New Year’s Eve is approaching and, for your New Year’s Eve, perhaps you will receive a small envelope with a note or check inside. Please note, you may have to declare this gift for taxes. Here are the rules to know to avoid unpleasant surprises.

This text corresponds to part of the transcription of the report above. Click on the video to watch it in full.

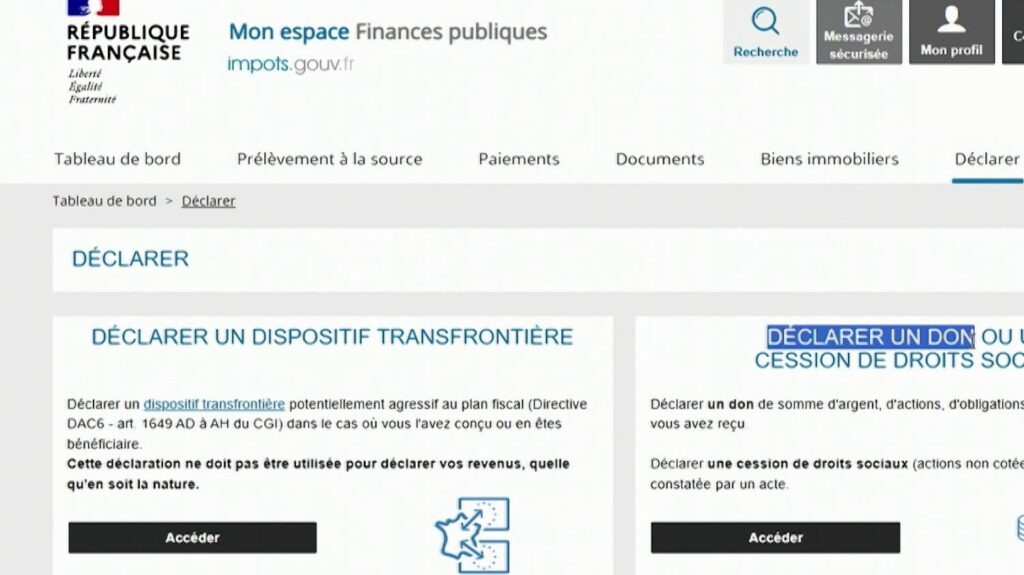

If you receive a sum of money from a loved one, did you know that you must declare it? If donations must be declared, the new thing is above all that from January 1, no more paper forms. Everything will be done exclusively online. We’ll explain it to you.

You will need to connect to the tax website to make your declaration. Amount, name of donor, a few clicks will suffice. But be careful, do you know who should take care of it? He is the one who receives.

This concerns sums of money, but not only: vehicles, jewelry, works of art are also affected. But be careful, because not all objects are equal. Anything received on special occasions, such as Christmas, birthdays or weddings, is considered a gift and does not need to be declared. Concretely, if your uncle left you 100 euros under the tree, you have nothing to do. On the other hand, if your grandmother gives you 10,000 euros during the year, you will have to take the necessary steps. If in doubt, declaring remains the best option. “These are truly exceptional donations that must be declared. (…) Don’t be afraid to declare. Declaring it doesn’t mean paying taxes.”assures Benoit Lety, journalist specializing in taxes – MoneyVox. In 2024, around 2% of donations between individuals will have been taxed.

/2025/12/29/video-26-6952932dab972327327131.jpg)