The end of automatic bank overdrafts is announced. Faced with a European directive which tightens, from 2026, the granting of small overdrafts, the government has some tools to limit the impact of this measure on households.

/2024/03/04/fanny-guinochet-65e60267ebb86457775765.png)

Published

Updated

Reading time: 3min

/2025/11/03/decouvertsbank-6908595deb678276730378.jpg)

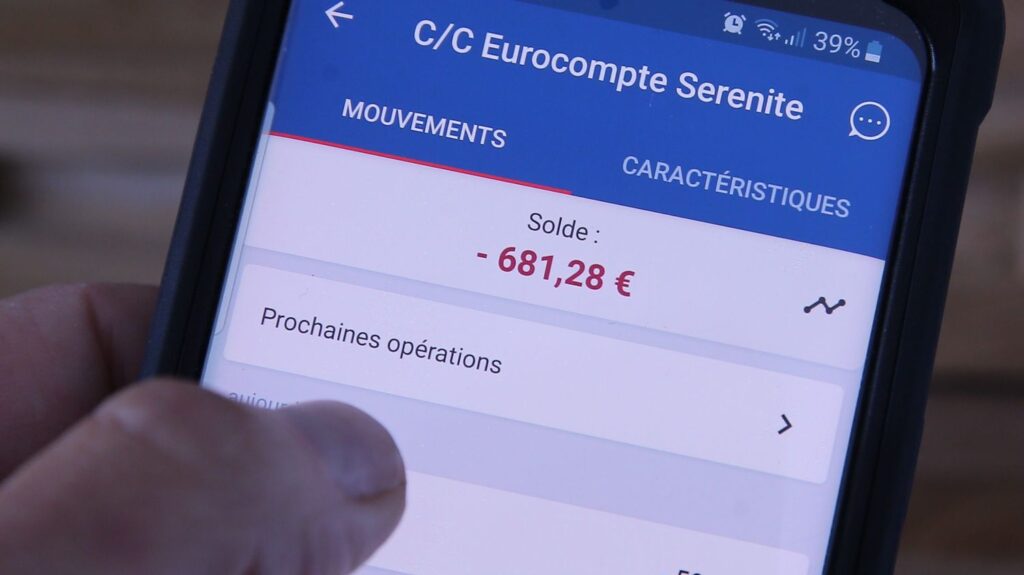

A European provision is causing controversy at the beginning of November because it will force French banks to be much more careful before granting their customers a bank overdraft authorization of less than 200 euros and less than one month, otherwise they will have to pay penalties. Concretely, this means that the banks will have to study your income, your bills, your rent, but also your possible credit incidents before authorizing you these small overdrafts, which make the lives of millions of French people easier.

Being uncovered will therefore not be prohibited, as La France insoumise says, but it will be much more regulated and more restrictive. On paper, this provision aims to protect consumers and limit over-indebtedness, but above all it risks penalizing many households. In fact, according to a survey on the site MoneyVoxmore than a third of French people have been overdrawn at least once in the last year, and a quarter are overdrafted every month. Tomorrow, they therefore risk being refused. Not to mention that access to credit promises to be tighter, because the European text now considers bank overdrafts as consumer loans. In other words, they will be included in the calculation of your debt. As the monthly charges must not exceed 30% of your net salary, if, in addition to your property loan, you have a few hundred euros overdraft, you risk being refused your loan.

Tuesday November 4, Roland Lescure, the Minister of the Economy, organizes a meeting in Bercy with banks and consumer associations. He can initially try to reassure, because this measure is worrying. Then, as the provision must be transposed in France in one year, in November 2026, the idea is to simplify things as much as possible so that the studies that banks will have to carry out on their customers are as light and as restrictive as possible. This is also what the French Federation of Banks will be asking for, but also the consumer associations who – for once – agree.

Please note, however, that for overdrafts above 200 euros, nothing changes, since prior authorization is already required. Finally, more generally, we can regret that Europe goes into such a level of detail and legislates on overdrafts of less than 200 euros, when it has many other subjects to deal with at the moment.