/2025/11/05/maxnewsworldfive446372-690b9e69528ce460002262.jpg)

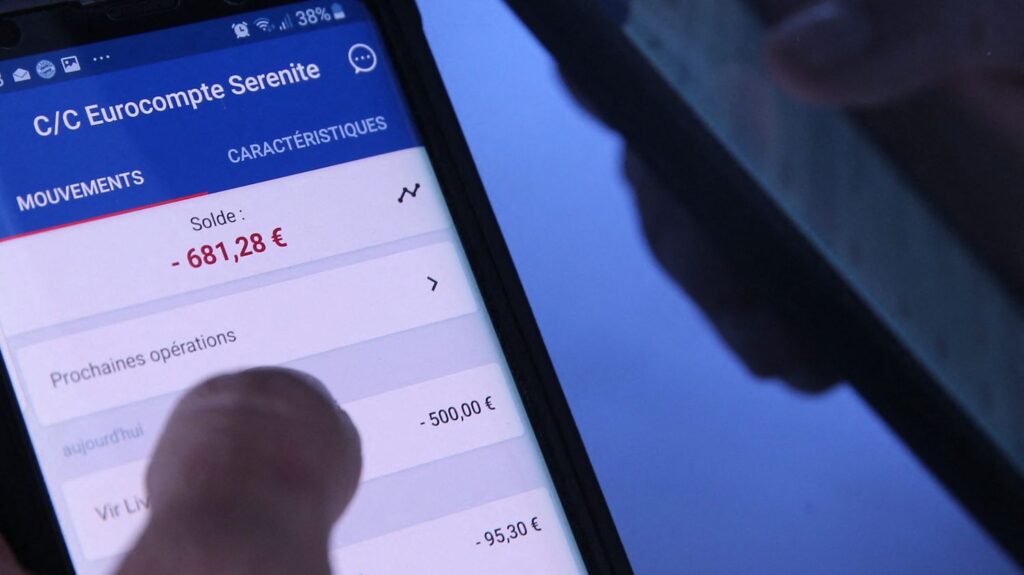

Many French people find themselves in the red every month and depend entirely on the overdraft granted by their bank to pay for daily expenses. These complex financial situations generate distress.

The day Isabelle* saw the news of a “ban coming soon” bank overdrafts, his blood only boiled. “As soon as it hits the wallet, it’s a bit of panic”modestly confides the fifty-year-old, who quickly sought to “learn more.” However, no overdraft ban is forthcoming, contrary to the assertions of certain elected politicians and the petition launched by Rebellious France. This involves the application of new European regulations, which will require, from November 2026, a solvency check to grant overdraft authorizations of 200 euros or less, and for less than one month. The rule will not concern customers who, like Isabelle, already have an overdraft authorization set up with their banking organization before this date.

For this 58-year-old local civil servant, a town hall employee, ending the month in the red is nothing new: her first financial difficulties appeared in 2000, shortly after the death of her husband. Isabelle can only count on herself to raise her 9-year-old granddaughter. And while her budget was strained, she took out consumer loans at that time, the monthly payments of which contribute to strangling her financially to this day. “Over the years, the overdraft has increased,” she relates. Currently, the authorization granted by his bank is 900 euros. A leniency that has a price: to be able to be negative every month or almost, she pays, every three months,“between 15 and 30 euros” to his bank, in the form of agios.

Isabelle has one goal in mind: not to exceed this threshold. “This has already happened to me and it costs a lot of money in intervention fees.” According to estimates from the consumer association 60 Million consumers as of 2017, these costs linked to operating incidents represent 30 to 35% of the turnover of retail banks. So, in order not to increase her overdraft, the fifty-year-old constrains herself to strict rules. Each of his expenses is recorded in an application on his cell phone, which helps him manage his budget as best as possible. “If my colleagues want to go for a drink or go to a restaurant, I find excuses not to go there”she continues. Isabelle experiences her difficulties in solitude and does not wish to confide in those around her. “I talk about it with my daughter (became an adult)but the subject is taboo with others. I’m a little ashamed of it all.”

“If they took away my authorized overdraft, it would be a disaster.”

Isabelle*, 58 years oldat franceinfo

In total, 31% of French people are overdrawn at least once a year, and a quarter of these (nearly 8%) say they are overdrafted every month, according to a MoneyVox survey published in August. This represents almost 8% of the total population. Among them, we find Thierry, 61 years old. This resident of Savoie suffers from psoriatic arthritis, a painful and particularly debilitating inflammatory disease. He lives on a disability pension and a disability supplement, or around 1,300 euros per month. “I am in permanent survival mode and chronically overdrawn”, sums up this former emergency doctor soberly.

“Even by reducing all my expenses to the extreme, I find myself in bank overdraft every month.”

Thierry, 61 years oldat franceinfo

His authorization was set at 800 euros and, for this, he pays between 5 and 10 euros to his bank each month. But, in the absence of savings, each hazard of life widens one’s overdraft a little further. “When I feel that things are going to get out of control and exceed the ceiling, I send an email to my bank to anticipate”, he explains.

To avoid worsening this deficit, Thierry, for a year, collected parcels of provisions every week from the Food Bank in his area, but the system, intended as a temporary solution, ended in June. “Now I buy a bag of gnocchi at the supermarket and count them one by one to estimate how many meals I can make with them, says the sixty-year-old. To buy food for my cat, I had to ask my daughter for help this month.” The latter, like her sister, now adults, live in the south of France. “I can’t even afford to go visit them, it’s too expensive.” Still due to lack of means, it took him more than ten years to be able to have a tombstone installed for his parents, who died in 2005 and 2012.

And while the news Banking regulations plan to align the rules around these overdrafts with those of consumer loans to protect customers from the danger of overindebtedness, Thierry does not recognize himself in this name. “For me, consumer credit means that you will live beyond your means, that you will enjoy leisure activities, extras. I don’t take out consumer credit, I take out credit to survive.”

Thierry is not the only one to think this way. In France, the overdraft is not seen as a credit “but as a little help at the end of the month”, explains Jeanne Lazarus, sociologist specializing in the relationship between French people and banks, research director at the CNRS and professor at Sciences Po. “Yet it costs money the month after, it can quietly lead to lower income and long-term economic stress if left unchecked,” she continues. There is thus a “ambivalence” in the system: the overdraft makes “genuinely a service, but otherwise indebted and can contribute to aggravating financial difficulties”she continues.

This new regulation also revealed, for Thierry, his dependence on an external system, which he does not control. “If tomorrow the banks change their overdraft and cash flow arrangements, I will be on the street, I will go and live under a bridge. I am totally dependent on the administration and the goodwill of the banks to live,” he notes bluntly. And to add: “This situation is more than anxiety, it is a real threat.”

Some French people even spend the majority of the year uncovered. “On the 5th of the month, when all the charges are out, I am in the red, and survival mode begins,” testifies Stéphanie*, a 37-year-old childminder earning 1,600 euros net per month and married to a train controller. This mother of three children has an overdraft authorization of 1,000 euros, which she uses almost every month, and pays a monthly contribution of 35 euros for this. “I was a single mother with two children when the banker proposed this solution, I then kept it”, she explains.

“What puts us in the most difficulty is loan repayments, we are on the verge of over-indebtedness”explains this resident of Ile-de-France. Their rent of 1,300 euros per month ends up putting the spouses in the red. This chronic overdraft is not without consequences for family life. “It creates discord in our relationship, we always have this stress, there are very often arguments around the financial aspect,” she confides.

A critical situation that she sometimes considers poorly understood. “When I read the comments on the internet from people who accuse overdrafted people of mismanaging their money, I have a hard time with it: I don’t buy luxury bags, I work non-stop, I don’t take vacations, I don’t have leisure activities, even going to a restaurant or going to the cinema has become a luxury”lists the thirty-year-old, who affirms: any tightening of the conditions of access to overdraft is bad news for the most precarious. “Only the wealthy classes are happy about it!”

* First names have been changed.