Published

Updated

Reading time: 2min – Video: 2min

2 minutes

The progressive pension system that allows you to work less and start to reach part of your retirement will be extended to 60 years from September 1.

This text corresponds to part of the transcription of the report above. Click on the video to watch it in full.

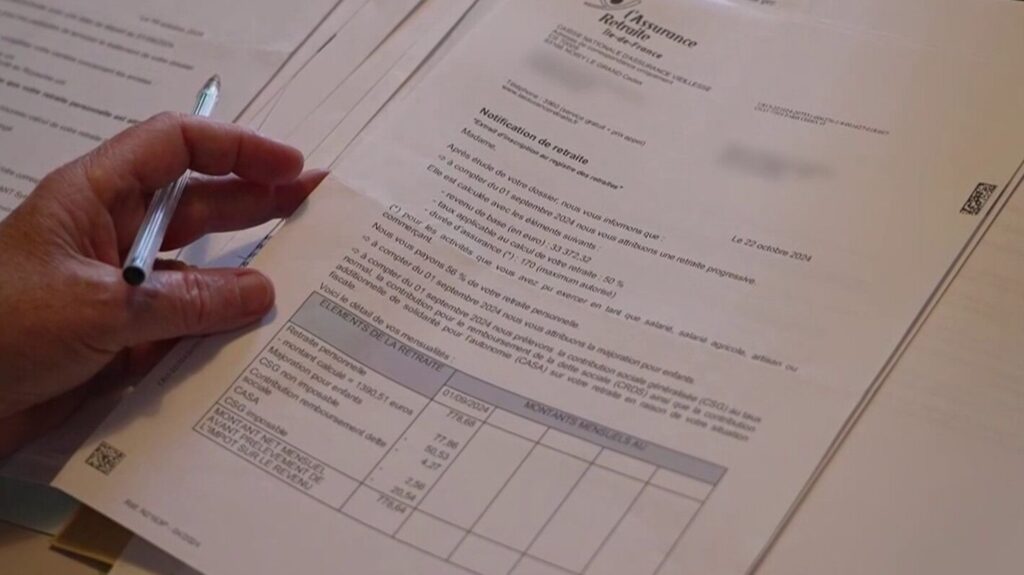

Work less and start touching part of your retirement. This is the choice of this employee of a private establishment. At 62, she is now enjoying a little more free time. “”For a very long time, I was too busy with work. And there, really, I start to feel, I see a little bit what it will look like in a year or two,“Indicates Candida Le Pénuizix, English Professor in gradual retirement. Last September, she decided to take a gradual retirement. Paying part -time, she works almost 3 days a week. The rest of his income is completed by the pension funds. “”My husband being retired for over a year, I did not want to continue working as much, to be able to accompany him more, and to be able to accompany our son who is with disabilities and who is autistic,“Confides Candida.

Like it, only 31,000 people benefit from this system. To make it more attractive, it will soon be possible to use it, from the age of 60, instead of 62 today, having worked at least 37 and a half. But can this device have an impact on your income? Take the case of an employee paid 2,596 euros net. By going to 60 % of activity, it is paid 1,558 euros. The rest is poured by the pension funds. But the pension is not sufficient in total. He loses 314 euros per month. Another risk, according to this expert, that of ending up with a lower pension for the real retirement. “”If I am only 60 %, I will only contribute to 60 %, so I will have a small loss of future retirement,“Explains Emmanuel Grimaud, founding president of Maximis Retraite.

To request a progressive retirement, the employee must have the agreement of his employer.

Non -exhaustive list.

/2025/07/23/retraite-progressive-bientot-d-6881389ca740d149453608.jpg)