The Financial Market Council (CMF) announced, Wednesday December 24, 2025, the resumption of trading of the “TGH” stock from Thursday December 25, 2025, after the company Tawasol Group Holding (TGH) established and published pro forma consolidated financial statements as of December 31, 2024in accordance with the instructions of the regulatory authority.

In a press release made public the same day, the CMF specifies that the company has taken into account the remarks made by the regulator as well as the reservations appearing in the auditors’ report relating to the consolidated financial statements closed as of December 31, 2024. The new pro forma financial statements include in particular the provisions subject to these reservations.

A significant turnaround in consolidated results

According to the CMF, the pro forma consolidated financial statements reflect the financial situation and performance that would have been observed if the reserves had been taken into account or corrected on the date of their actual occurrence. These statements show a pro forma consolidated result – share of the loss-making group of 3,306,950 dinars, compared to a consolidated result – share of the profitable group of 1,148,591 dinars in the consolidated accounts initially published.

These pro forma consolidated financial statements have been audited by the company’s auditors, whose report accompanies the publication.

Return to the suspension decided on December 16, 2025

As a reminder, on December 16, 2025, the stock market watchdog decided to suspend the listing of the TGH stock from Thursday, December 18, 2025. This decision followed a meeting held the same day at the CMF headquarters with the general manager of Tawasol Group Holding and its auditors, relating to the reports certifying the financial statements for the 2024 financial year.

According to the press release then published by the CMF, these reports revealed the existence of recurring and unregularized reserves, persisting over two or more consecutive years. The regulator made the resumption of trading conditional on the publication by the company of a press release containing in particular the preparation of pro forma consolidated financial statements.

Opinion of independent auditors on pro forma accounts

In their report dated Monday, December 22, 2025, the independent auditors Hedi Mallekh and Moez Ben Ali issued their opinion on the pro forma consolidated financial statements for the financial year ending December 31, 2024.

The auditors indicate that these financial statements, including the pro forma consolidated balance sheet, the pro forma consolidated income statement, the pro forma consolidated cash flow statement and the related explanatory notes, show a total of the pro forma consolidated balance sheet of 145,599,470 dinars and a pro forma consolidated result – share of the group in deficit of 3,306,950 dinars.

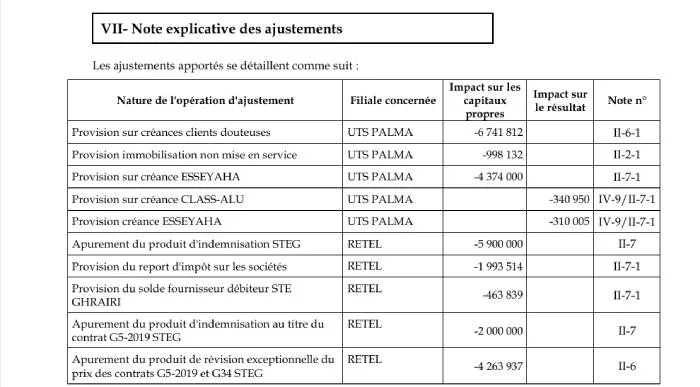

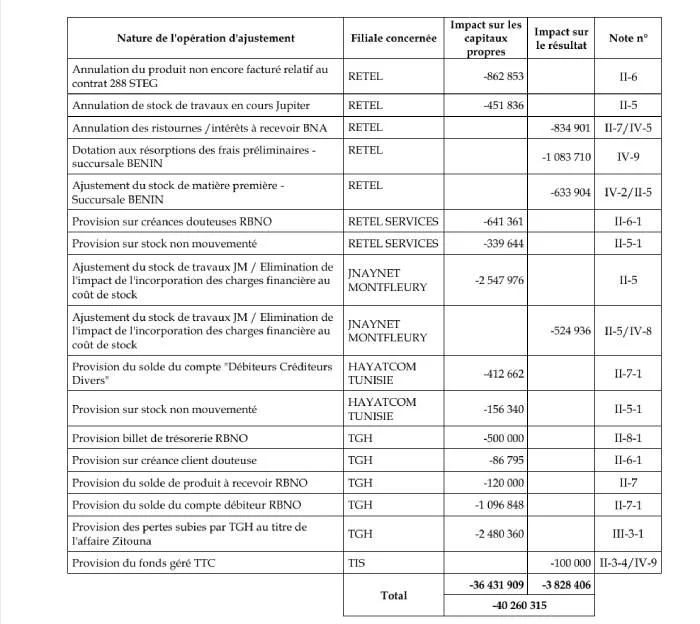

In their opinion, the auditors consider that the pro forma financial information has been properly compiled, based on the criteria described in Note VII – Explanatory note of adjustments, based in particular on taking into account the lifting of the quantifiable reservations formulated in their audit report of the consolidated financial statements dated Tuesday, December 3, 2025. They specify that this basis is consistent with the company’s accounting methods and the principles of the corporate accounting system.

Scope limitations still present

Without modifying their opinion, the auditors nevertheless draw attention to the limitations inherent in pro forma financial information. Certain reservations formulated in their report of December 3, 2025 could not be subject to pro forma adjustments, due to limitations of scope whose impact cannot be reliably determined.

These include:

- the absence of a physical inventory of tangible assets;

- the absence of audited financial statements for subsidiaries based in Algeria;

- the impossibility of verifying cash balances abroad;

- the absence of conclusive supporting documents for advances on the acquisition of fixed assets abroad.

Consequently, although the pro forma accounts include the lifting of reserves relating to provisions (bad debts and risks) and the scope of consolidation, in particular the UTS-PALMA case, they remain affected by uncertainties linked to these limitations of scope.

A heavy adjustment to the net result

According to the pro forma consolidated financial statements, the consolidated net income suffered a negative adjustment of 3,828,406 million dinars, going from approximately 1.16 million dinars at the end of 2024 to –2.66 million dinars on a pro forma basis.

For its part, the group’s consolidated result recorded an even more marked adjustment of -4.45 million dinars, moving from a profit of 1.15 million dinars at the end of 2024 to a loss of 3.31 million dinars in pro forma at December 31, 2024.

Resumption of trading from December 25, 2025

In light of these elements and in accordance with its instructions, the Financial Market Council has confirmed that the trading of the “TGH” stock will resume on Thursday December 25, 2025, thus putting an end to the suspension decided a week earlier, while maintaining a framework of vigilance around the financial situation of the group.

I.N.