/2025/10/15/invite-tout-est-politique-1510-68eff97dd891a814447793.jpg)

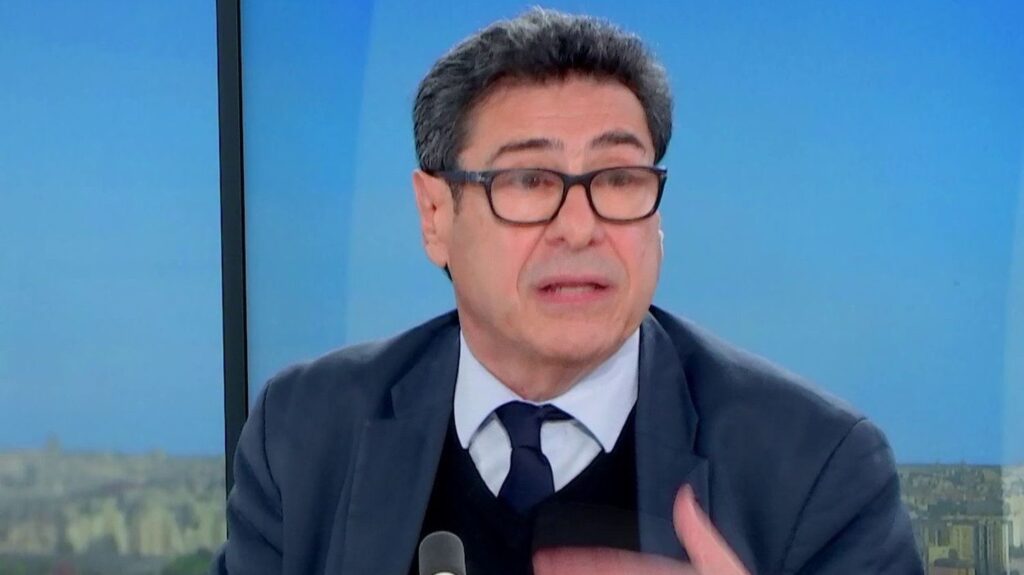

Guest of “Everything is political” on Wednesday October 15, the economist Philippe Aghion, awarded the 2025 Nobel Prize in Economics, returns to the question of inequalities in France, focusing on education and the taxation of high incomes.

While the 2026 draft budget of Sébastien Lecornu’s new government provides for billions in savings, including tax increases on high incomes, Philippe Aghion, 2025 Nobel Prize winner in economics, comments in “Everything is politics” on Wednesday October 15, the choices of the executive and the ongoing debates in the political class.

This text corresponds to part of the transcription of the interview above. Click on the video to watch it in full.

Sonia Chironi: You say that inequalities are not that strong, and that ultimately, the French system is one of the most redistributive in the world. But my question, all the same, was: do we tend to forget a little in the debate we are having in France in recent weeks, that we are still redistributing a lot in our country?

Philippe Aghion: So, I think that indeed, we tend to forget that France is one of the most redistributive countries, where income taxation is the highest. But that said, I have a concern about inequality. This is inequality of access to quality education, equality of opportunity, for example. What concerns me a lot is social mobility. For me, what is most revolting are the poverty traps and the fact that social origin determines your future. That’s what revolts me. I am truly a social democrat, but I am a social democrat who is committed to ensuring that any talent, whatever their social origin, can flourish and have the same chances of achieving themselves. And there was a big deterioration in France. Like never before, educational performance is linked to the social environment. In particular, performance on PISA tests. I’m not saying that we shouldn’t have new measures to tax, and we’re going to talk about that later, but I think that inequality is first and foremost at school, that’s where it happens first.

Nathalie Saint-Cricq: We cannot say that it is due to lack of resources.

No, no, no, I didn’t say that at all…

But I ask you, to what do you attribute it; to the drop in quality, to the fact that selection is refused, that there is a lack of teachers? What is the cause?

So, it could be one of the poorly allocated resources. It’s not fair that we don’t spend enough. We have a school, we must carry out a reform like the Finns did, or like the Portuguese did recently. That is to say… I am going to put the emphasis at school on calculation. First, the manuals. We need to go back to the textbooks. I am very traditional when it comes to education. I think that at school, you need to have books, beautiful books that you cover well, where you study grammar and arithmetic. I think it must be basic subjects. I strongly believe that emphasis should be placed on basic subjects, textbooks. And the manual that we abandoned too much. I’m against, obviously, iPhones in school, etc. I think that homework should also be done at school as quickly as possible and that there should be tutors for students in difficulty and that there should, obviously, be fewer students in classes. This could mean investments or a reallocation of investments. The Finnish system, I’ll tell you how it works: at the centralized level, you have the program. The programs are designed centrally, like at home. Then, teachers must complete five years of training after the baccalaureate, including a year and a half of teaching, and they are retrained regularly. And then, the evaluation of schools is centralized. So we can compare performances and see if there is a school that works. The rest is quite decentralized. We should decentralize the rest much more. But with centralized programs, teacher training with centralized standards and centralized evaluation. And the rest should be quite decentralized, but with basic ideas. Calculation, grammar, dictation… You have to do dictations all the time, spelling mistakes are not acceptable. And homework at school, smaller classes, well-trained, well-paid teachers, if they do more, the teachers should be properly paid, because otherwise what happens is that no one wants to be a teacher and we accept teachers at a very low level. And a system of tutors for students in difficulty. If we do all that, it doesn’t necessarily mean spending more, but perhaps spending better.

That still means that you are undermining nearly 50 years of classic pedagogism, by saying that we have to stop taking grades…

Absolutely, on this, I am very reactionary. But with tutors, smaller classes… That is the most important source of inequality in France. This is also the work of my friend Xavier Jaravel. If children from disadvantaged classes had the same access to education as the advantaged, we would have much more growth and innovation in France. And that’s the wonderful work on the book The lost Marie Curies by Xavier Jaravel. And I advise you to read this book, which is wonderful. So that is the main source of inequality. You see, it’s much more important. And that’s what seems strange to me, if you like, the time that the Socialist Party devotes to the Zucman tax compared to what I just talked about. I find it absurd not to talk much more about the growing inequality, that is to say, that of equality of opportunity and social mobility.

Sonia Chironi: Should we still tax more the very rich who, proportionally, pay less taxes than the middle class?

So, I think there is a real problem indeed, but I don’t want to do it in a punitive way. First, we must encourage people to take action. I don’t want to tax the work tool more. I don’t want to penalize someone like Arthur Mensch who created Mistral, which is our hope in artificial intelligence. And if we applied the Zucman tax, it is good that we impose it on unrealized income. The Zucman tax means that he is valued, so his firm is valued at 12 billion. He doesn’t earn anything at the moment. They should find financiers, not to innovate, but to pay taxes on income they do not realize. There are competitors in other countries who don’t have to do this. That means we’re losing the AI race. You put the Zucman tax, that means that France is escaping the AI revolution. That’s what it means, immediately. So, shouldn’t we still do something for the rich? Yes. That is to say, in my opinion, the assets are high, but the non-productive use is a little higher; The Dutreil niche is very good, but it needs to be laid out. There are people who abuse it. I am not saying that heritage holding companies should be eliminated. But there are people who buy their chalet, their personal plane with these holding companies. You have to look at them. That is to say, I am for an overhaul and to fight against abuse. And perhaps an exceptional tax on heritage, but not on heritage, I exclude the tool. Those are my basic rules.

Click on the video to watch the interview in full.