Published

Reading time: 2min – Video: 2min

2 minutes

For taxes, 13 million households will have to pay a balance next September, for an average of 2,000 euros. The number of households concerned has increased since last year, how to explain the increase?

This text corresponds to part of the transcription of the report above. Click on the video to watch it in full.

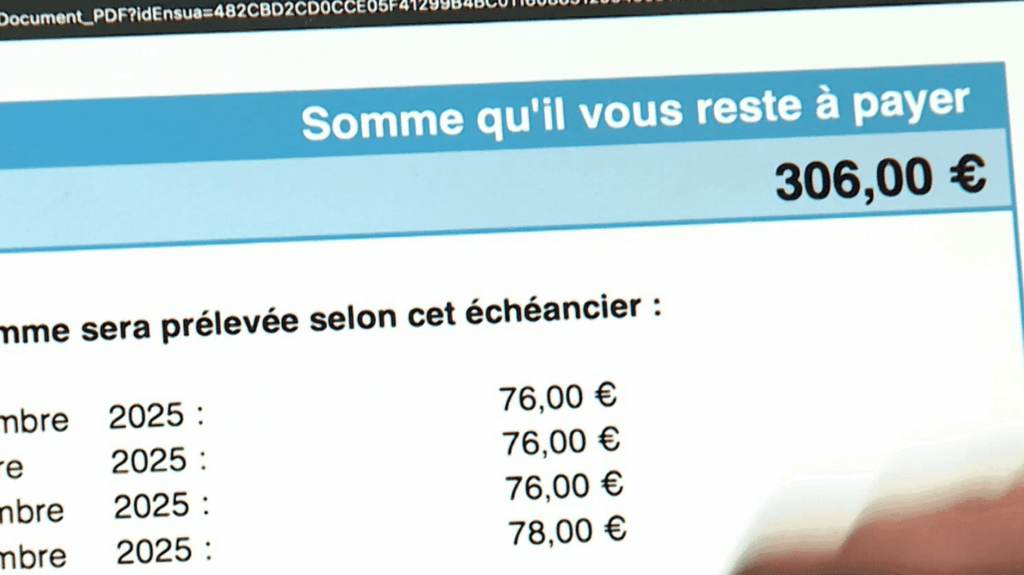

The bad news of summer, Pierre Lostenlen discovered it on the tax site. “There, I have just received my 2025 taxation on the income of 2024 and I have just learned, unfortunately, that I have a remainder of 306 euros, explained the consultant.

Each month, however, it was taken from 152.72 euros directly on its wages, an amount calculated from its tax rate, which remained unchanged from the past year. But his income has increased. “In 2024, I made a little rental on a well-known platform in France, around 2,000 euros per year over thirty nights, which made me pass through a superior tax tranche,” he detailed.

Like him, 13.1 million tax households have a tax balance to pay this year: 1,901 euros on average. These are concerned those whose tax situation changed in 2024, after a divorce for example or the departure of a dependent child, but also people whose remuneration has increased. And there were many in 2024. The income tax scales increased around 2-3 %. It follows that, if we have an increase in salary of 5, 6 or 7 % and we have not previously anticipated it, we find ourselves not having been taken sufficiently on our pay sheet and therefore having to make an extension for the 2024 taxation, “said Olivier Villois, national secretary of the CGT for public finances.

To avoid unpleasant surprises in the event of a change in income or family situation, you can adjust your withholding tax rate directly to the tax site.

/2025/07/30/impots-6889b8c2a0685638991384.png)